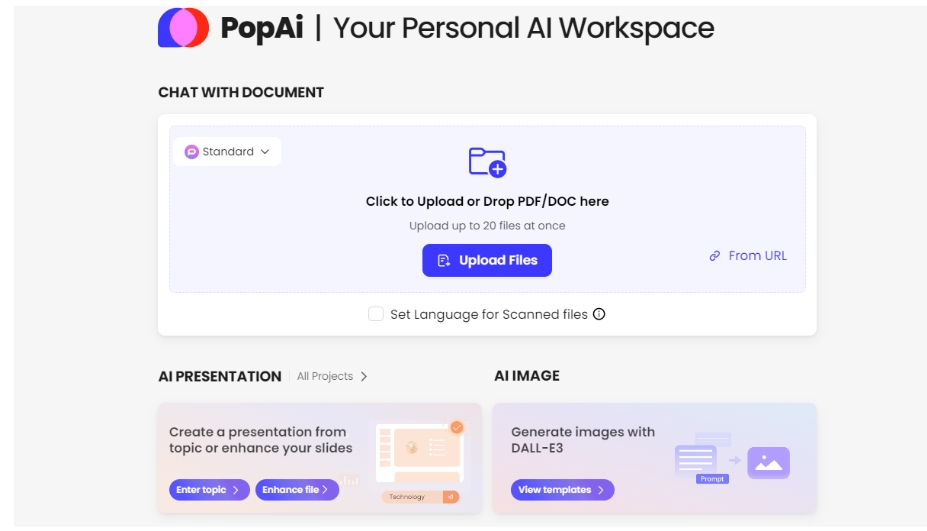

Managing personal finances can be a daunting task, involving budgeting, saving, investing, and planning for the future. Fortunately, advances in Artificial Intelligence (AI) have made it easier to navigate the complexities of personal finance. PopAi, a versatile AI tool, offers a range of functionalities that can significantly enhance your financial management efforts. This blog will explore how PopAi’s features can help you manage your personal finances more effectively and provide practical tips for utilizing these tools.

Investment Analysis and Planning

Investing is a key component of personal finance, and PopAi can provide valuable insights and recommendations to help you make informed investment decisions.

Applications:

Portfolio Analysis: Analyze your investment portfolio to assess performance and identify areas for diversification.

Risk Assessment: Evaluate the risk level of your investments and receive recommendations for balancing risk and reward.

Investment Recommendations: Get personalized investment recommendations based on your financial goals, risk tolerance, and market trends.

Tips:

Diversify Investments: Diversify your investments to reduce risk and improve potential returns.

Long-Term Planning: Focus on long-term investment goals and avoid making impulsive decisions based on short-term market fluctuations.

Stay Informed: Keep up with market trends and financial news to make informed investment decisions.

Financial Goal Setting and Tracking

Setting and tracking financial goals is essential for staying motivated and achieving financial success. PopAi can help you set realistic goals and monitor your progress.

Applications:

Goal Setting: Define specific financial goals, such as saving for retirement, paying off debt, or building an emergency fund.

Progress Tracking: Track your progress towards your financial goals and receive updates on your achievements.

Motivational Reminders: Set up reminders and notifications to keep you motivated and focused on your goals.

Tips:

Specific Goals: Set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

Break Down Goals: Break down larger goals into smaller, manageable milestones to make progress more achievable.

Celebrate Achievements: Celebrate your achievements and milestones to stay motivated and recognize your progress.

Practical Tips for Using PopAi in Personal Finance

Automate Routine Tasks

Automation can save time and reduce the risk of errors in your financial management. Use PopAi to automate routine tasks such as expense tracking, budgeting, and investment analysis.

Tips:

Link Accounts: Link your bank accounts, credit cards, and investment accounts to PopAi for automatic tracking and updates.

Set Up Alerts: Set up alerts for important financial events, such as bill due dates, budget limits, and investment opportunities.

Schedule Reviews: Schedule regular financial reviews to assess your progress and make necessary adjustments.

Leverage Data-Driven Insights

PopAi provides valuable data-driven insights that can help you make informed financial decisions. Use these insights to optimize your budget, investments, and financial plans.

Tips:

Analyze Trends: Analyze spending and investment trends to identify areas for improvement and opportunities for growth.

Forecast Scenarios: Use predictive analytics to forecast future financial scenarios and plan accordingly.

Personalize Recommendations: Take advantage of personalized recommendations to tailor your financial strategies to your unique needs and goals.

Stay Organized and Consistent

Consistency and organization are key to effective financial management. Use PopAi’s tools to stay organized and maintain a consistent approach to your finances.

Tips:

Use Templates: Use PopAi’s templates for budgeting, financial planning, and reporting to maintain consistency.

Keep Records: Maintain detailed records of your income, expenses, savings, and investments.

Regular Updates: Update your financial plans and reports regularly to reflect changes in your financial situation and goals.

Conclusion

PopAi’s powerful suite of AI tools offers a comprehensive solution for managing personal finances. By leveraging features such as the AI presentation tool, image generator, expense tracking, and investment analysis, you can streamline your financial management processes, make informed decisions, and achieve your financial goals. Whether you’re a seasoned financial planner or just starting your personal finance journey, PopAi provides the tools and insights needed to succeed.